- VC Brags Newsletter

- Posts

- China's Startup Boom Stalls

China's Startup Boom Stalls

Investors Retreat from Chinese Startups, Highland Bets a Billion on Europe, and a Paris-Startup Takes a Quantum Leap.

Welcome Shareholders,

First off, a huge thanks to all of the new shareholders joining us. In this daily edition of the Brags Newsletter, we'll cover the latest on China's venture ecosystem, a Tech VC defying the economic slowdown in Europe by raising their largest round to date, and a Paris startup's differentiated approach to building quantum computers.

So sit back, grab a snack, and enjoy!

Venture Today 👏

The regulatory crackdown on tech companies, along with stringent COVID-19 policies, has led to a 46.4% year-on-year decline in venture funding for Chinese startups in 2022.

VC deal volume in China decreased 14.4% from 4,388 in 2021 to 3,755 in 2022, and the disclosed funding value dropped 46.4% from $107 billion in 2021 to $57.4 billion in 2022.

Furthermore, the average size of VC funding deals in China also decreased from $24.4 million in 2021 to $15.3 million in 2022. Funding dropped in other key markets as well, including the US, UK, and India, with 40.8%, 24.3%, and 38.2%, respectively, but China has seen the biggest drop.

Who's Raising?

Venture Firm Highland Europe said that it successfully closed a new €1 billion fund, despite the broader economic slowdown impacting the technology industry.

This is Highland's fifth fund, bringing the total capital raised to €2.75 billion. The new fund will finance private software and consumer internet companies across Europe, bucking the current slowdown in the Tech Venture landscape across Europe.

Highland Europe, a London and Geneva-based venture capital firm, spun off from Highland Capital Partners in 2012. The company's portfolio was valued at $5.6 billion last year, with successful investments including file transfer startup WeTransfer, Meal replacement company Fuel, and food delivery firm Wolt, which DoorDash acquired in 2021 for €7 billion.

Startup of the Day

Paris-headquartered quantum computing startup Pasqal said it had raised €100 million through a Series B, led by Singapore's Temasek.

Other investors in the round include Quantonation, the Defense Innovation Fund, Daphni, Eni Nex, the European Innovation Council (EIC) Fund, Wa'ed Ventures, and Bpifrance. Pasqal, founded in 2019, stands out from other quantum computing startups due to its focus on neutral atom quantum computing, a novel approach that utilizes lasers to hold atoms in place.

This contrasts the existing solutions of trapping ions by IonQ or superconducting quantum computers like IBM. Pasqal is currently piloting its technology with customers including Crédit Agricole CIB, BASF, BMW, Siemens, Airbus, Johnson & Johnson, and Thales. The company's most recent computer had 350 quantum bits (qubits), but it expected it to reach 1000 qubits in a few years.

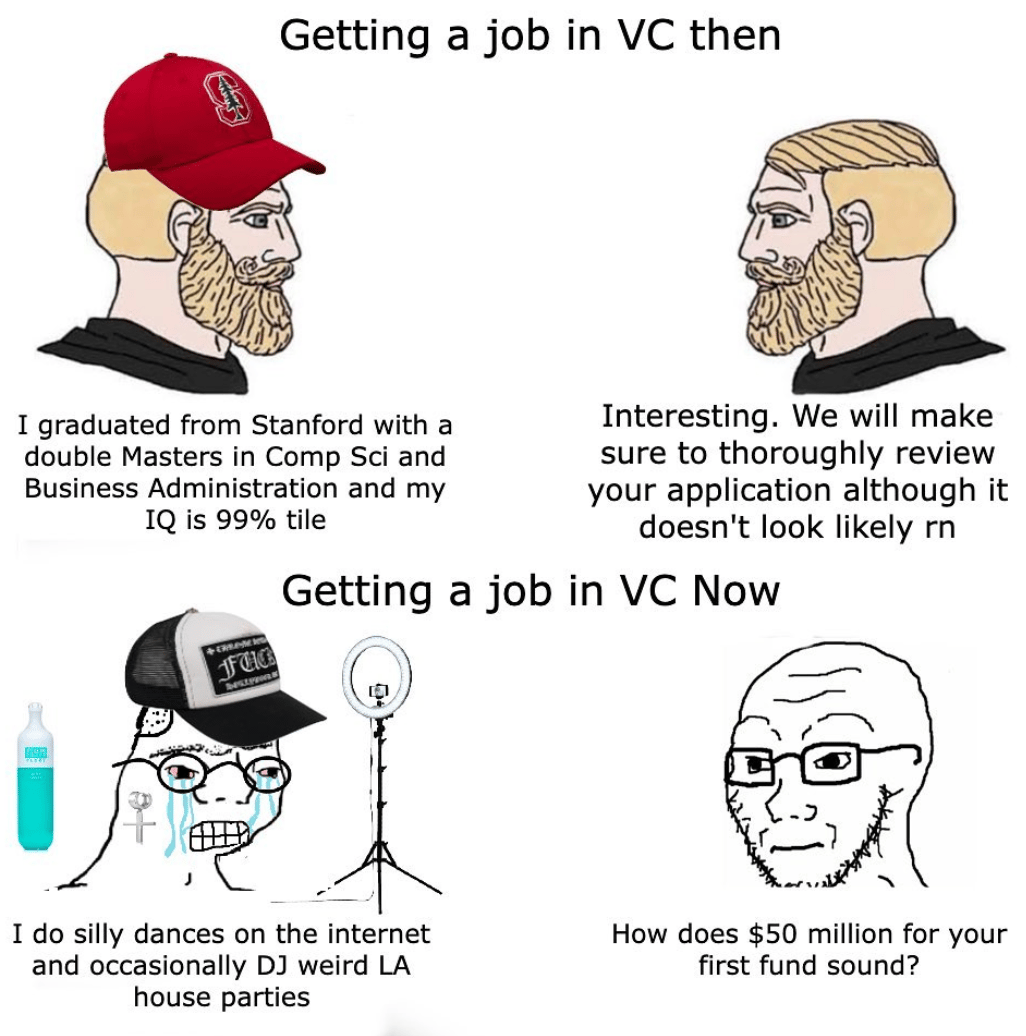

Memes and Other Things